| RESOURCES |

|

|

| |

Important Datelines:

JANUARY 1:

Employers must stop advance payments of the earned income credit.

JANUARY 10:

Employees who received $20 or more in tips in the month of December must report the amount to their employer on form 4070.

JANUARY 15:

Individuals must pay the final installment on your 2013 estimated tax.

If the monthly deposit rule applies, the employer must deposit the tax for nonpayroll withholding payments made in December 2013.

Farmers and Fisherman must pay their estimated tax for 2013.

JANUARY 31:

Employers must file their federal unemployment tax (form 940) for 2013. If the tax for the year has been paid in full and on time you have until February 10th to file the return.

Employers must file form 941 (social security, medicare and withheld income tax) for the fourth quarter of 2013. If you deposited the tax for the quarter in full and on time you have until February 10th to file the return.

Employers must file form 945 to report income tax withheld for 2012 on nonpayroll items. If you deposited the tax for the quarter in full and on time you have until February 10th to file the return.

Employers must provide their employees with their 2013 W-2 forms.

Businesses must give annual information statements to recipients of 1099 payments made in 2013.

Gambling winners should receive form W-2G.

Employers must file form 730 and pay the tax on wagers accepted during December 2013.

File your tax return if you did not pay your last installment of estimated tax by January 15.

FEBRUARY 10:

Employers must file their federal unemployment tax (form 940) for 2013. Due date applies if employer deposited the tax for the year in full and on time.

Employers must file form 941 (social security, medicare and withheld income tax) for the fourth quarter of 2013. Due date applies if employer deposited the tax for the year in full and on time.

Employers must file form 945 to report income tax withheld for 2013 on nonpayroll items. Due date applies if employer deposited the tax for the year in full and on time.

Employees who received $20 or more in tips in the month of January must report the amount to their employer on form 4070.

FEBRUARY 18:

Individuals must file a new form W-4 to continue claiming an exemption from income tax withholding in 2013.

Businesses must provide forms 1099-B, 1099-S, and certain Forms 1099-misc to recipients.

FEBRUARY 19:

Employers need to begin withholding on employees who claimed exemption from withholding in 2013 but did not file a W-4 to continue withholding exemption in 2014.

FEBRUARY 28:

Businesses and payers of gambling winnings must file Form 1096 (Annual Summary and transmittal of U.S. Information returns) along with Copy A.

Employers must file Form W-3 (Transmittal of Wage and Tax Statements) and Copy A of all the Form W-2 that were issued.

Employers who have employees who work for tips must file Form 8027 (Employers annual information return of tip income and allocated tips).

MARCH 3:

Farmers and fishermen must file form 1040 and pay any tax due. You have until April 15th to file if you paid your 2013 estimated tax payments by January 15, 2014.

MARCH 10:

Employees who received $20 or more in tips in the month of February must report the amount to their employer on form 4070.

MARCH 15:

If the monthly deposit rule applies, the employer must deposit the tax for nonpayroll withholding payments made in February.

Corporations must file their 2013 calendar year income tax return and pay any tax that is due. If an automatic 6-month extension is necessary Form 7004 along with estimated tax must be filed.

S-Corporations must file their 2013 calendar year income tax return and pay any tax that is due. Shareholders must be provided with a copy of Schedule K-1. If an automatic 6-month extension is necessary Form 7004 along with estimated tax must be filed.

MARCH 31:

Employers must file form 730 and pay the tax on wagers accepted during February.

|

| |

Extensions:

The IRS may be able to grant you an automatic 6 month extension.

Form 4868 must be filed by te tax due date, usually April 15.

Please keep in mind the extension is only to allow time for you to file your tax return, your tax liability is due at the end of your calendar year (usually April 15). The IRS does not grant you any extension of time to pay your tax liability.

|

| |

Possible Payment Plans:

1. Request an Extension of Time to Pay - Depending on the taxpayer situation, the taxpayer may be able to qualify for an extension of time to pay. A taxpayer can request an extension from 30 to 120 days. Requesting for an extension to pay does not release the taxpayer from owing penalties or interest, generally penalties and interest will be less than if the debt were repaid through an installment agreement.

2. Installment Agreement - The installment agreement allows a taxpayer to pay remaining balance in monthly installments. Taxpayers are able to propose the monthly payment and the date they wish to make their payment each month. The IRS charges a $105 fee for setting up an installment agreement but can be reduced to $52 if set up a direct debit installment agreement. Taxpayers are required to pay interest plus a late payment penalty on the unpaid taxes for each month. A taxpayer who does not file the return by the due date or file for an extension by the tax due date may have to pay a failure-to-file penalty.

|

| |

Social Security Benefits:

*You should receive a Form SSA-1099 showing the total amount of your benefits.

* The information provided on form SSA-1099 and the three facts listed below will help you determine whether or not your benefits are taxable.

1. How much if any of your Social Security benefits are taxable depends on your total income and marital status.

2. Generally, if Social Security benefits were your only income for 2013, your benefits are not taxable and you probably do not need to file a federal income tax return.

3. If you received income from other sources, your benefits will not be taxed unless your modified adjusted gross income is more than the base amount for your filing status.

A. Your taxable benefits and modified adjusted gross income are figured on a worksheet in the Form 1040A or Form 1040 Instruction booklet.

B. You can do the following quick computation to determine whether some of your benefits may be taxable:

> First, add one-half of the total Social Security benefits you received to all your other income, including any tax exempt interest and other exclusions from income.

> Then, compare this total to the base amount for your filing status. If the total is more than your base amount, some of your benefits may be taxable.

***2013 base amounts are:

> $32,000 for married couples filing jointly.

> $25,000 for single, head of household, qualifying widow/widower with a dependent child, or married individuals filing separately who did not live with their spouses at any time during the year.

> $0 for married persons filing separately who lived together during the year.

|

| |

Tips:

1. Tips are taxable and are subject to federal income, Social Security and Medicare taxes.

2. The value of non cash tips are also considered income and subject to tax.

3. Tips reported on your tax return under gross income.

4. If you receive $20 or more in tips in any one month, you should report all of your tips to your employer.

Your employer is required to withhold federal income, Social Security and Medicare taxes.

4. Keep a running daily log of your tip income ( see IRS Publication 1244).

|

| |

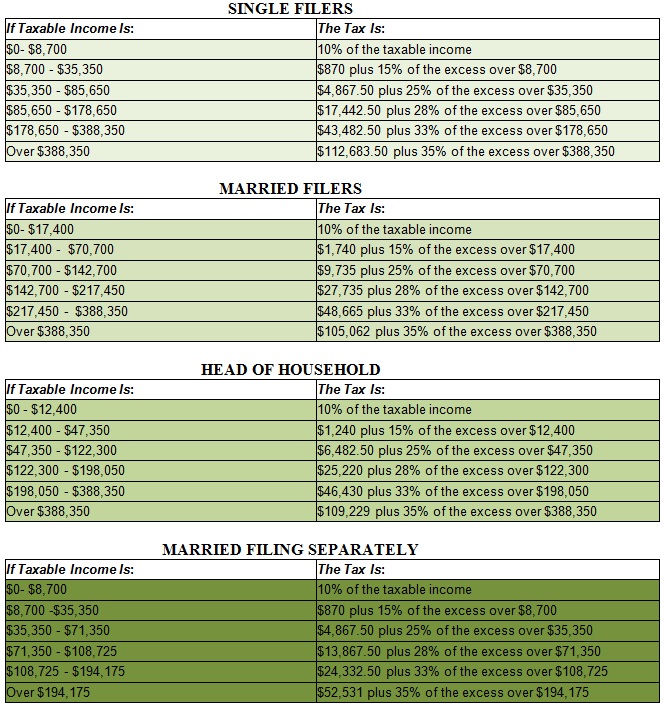

Tax Tables:

|

|

|

|

|

|

|

|

|